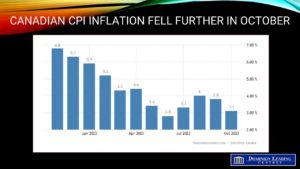

“Canadian Inflation Dips to 3.8% Keeping BoC On The Sidelines” from @DLCCanadaInc Chief Economist

According to Bloomberg calculations, another critical measure, a three-month moving average of underlying price pressures, fell to an annualized pace of 2.96% from 3.67% a month earlier. It’s an important metric because Bank of Canada Governor Tiff Macklem has said policymakers are tracking it closely to understand inflation trends.

Today’s news shows that tighter monetary policy is working to bring down the inflation rate. In its Monetary Policy Report last month, the Bank of Canada expected the CPI to average 3.5% through mid-2024. Cutting its economic forecast, the Bank forecasted it would hit its 2% inflation target in the second half of 2025.

Given today’s data and the likely significant slowdown in Q3 GDP growth, released on November 30, and the Labour Force Survey for November the following day, policy rates have peaked. Governor Tiff Macklem will give a speech on the cost of high inflation in New Brunswick tomorrow, and the subsequent decision date for the Governing Council is December 6th. The Bank’s inflation-chopping rhetoric may be relatively hawkish, but the expectation of rate cuts could spur the spring housing market.

The economists at BMO have pointed out that “three provinces now have an inflation rate below 2%, while only three are above 3%, so much of the country is already seeing serious signs of stabilization. (Unfortunately, the two largest provinces have the fastest inflation rates—Quebec at 4.2% and Ontario at 3.3%).” There is no need for the Bank to raise rates again, and they could begin to cut interest rates in the second quarter of next year.