|

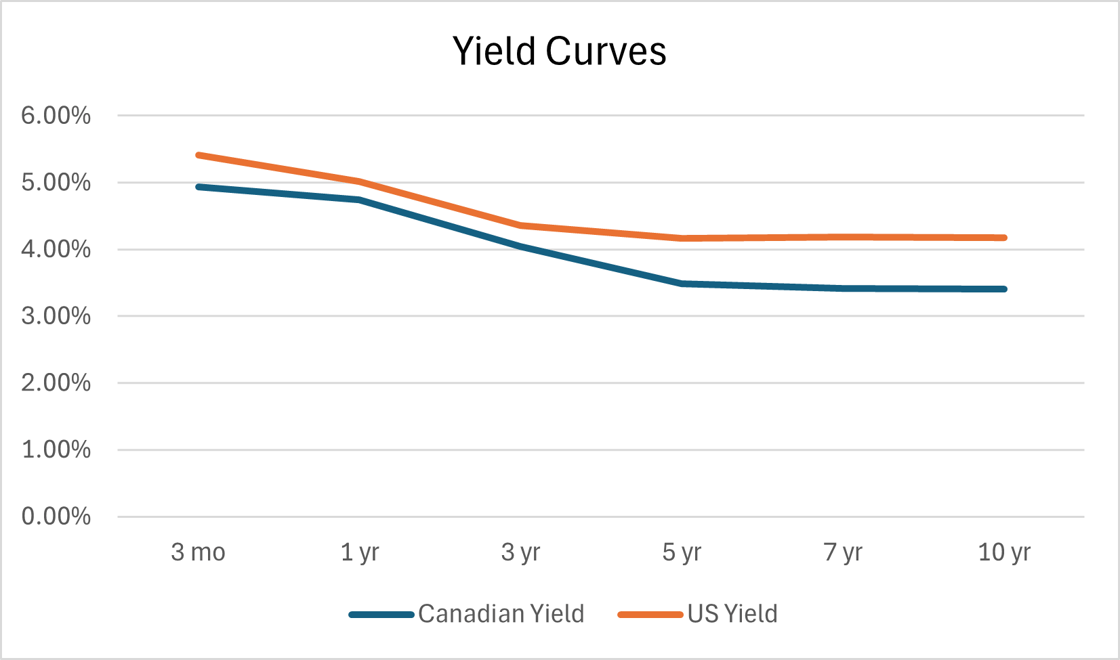

The Bank of Canada (BoC) left its overnight rate unchanged last week. The US and Canadian yield curves have risen slightly for most maturities. |

|

**The above chart reflects rates as of 9:30AM Eastern, 2024-03-13.**

THE IMPACT ON MORTGAGE RATES:Shorter term mortgage rates will be remain higher than long term rates as a result of the inverted yield curve. That’s why variable-rate and short-term fixed rates are higher than 5-year fixed rates.

As a Mortgage Professional, I keep a watch on bond yields. They predict the movement of mortgage rates. For example, if the 5-year bond yield rises, you can expect the 5-year fixed-rate to increase. |